Tense start to the year

Where do we go from here?

Munich, 13 Apr. ’22

Q1 2022: Review

Surprisingly, Covid did not focus on the first quarter of 2022, but sadly, it was dominated by the war and its human abyss. The Russian invasion of Ukraine did not leave the stock markets cold either and caused a significant correction movement in February, especially on the European stock exchanges.

The strict international sanctions against Russia confirmed the resolute action against President Putin, but also revealed the other side of the coin of international interdependence and its economic consequences. The short-term tripling of the nickel price and doubling of the wheat price, as well as the return of the oil price to the old price level of over USD 100, were emblematic of the problematic commodity dependencies of individual countries and commodity producers.

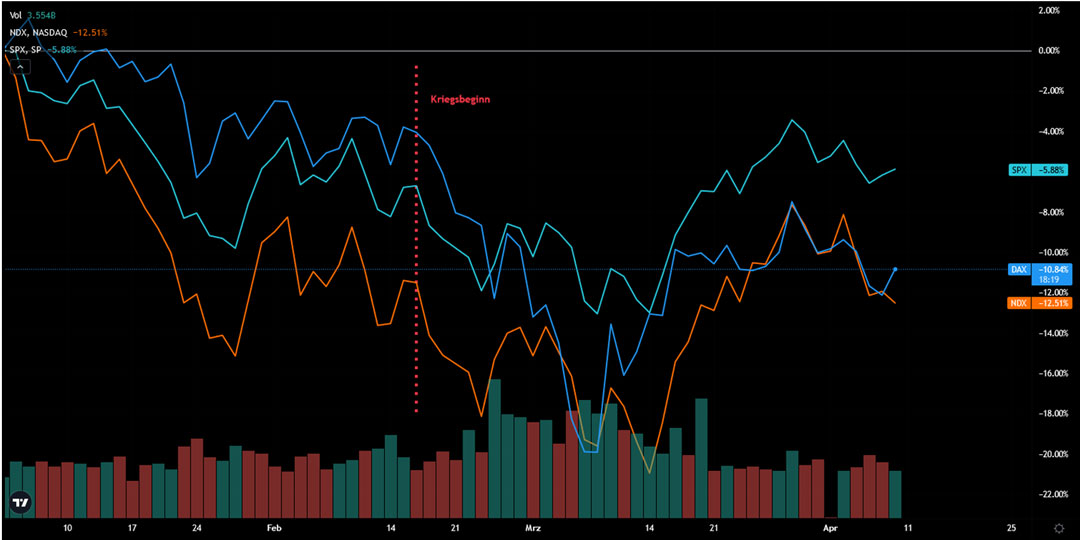

The persistently high inflation finally prompted the FED to initiate the interest rate turnaround in March and to concretize its plans with regard to further interest rate hikes in 2022. The fact that this interest rate hike did not come as a surprise to most investors became apparent in the second half of March, when the stock markets started to recover and (almost) reached their pre-war levels again (S&P 500 / NASDAQ / DAX):

The war situation is likely to keep us busy in the second quarter as well. Even if an agreement between Russia and Ukraine is reached soon, the economic consequences should continue to affect us in the coming quarters. This is because the shortage of raw materials is likely to become a problem in the coming quarters as well, affecting supply chains.

An open question for Q2 will be whether international investors and investors will now gradually start to tune out the war scenario. There is also the question of the extent to which the planned interest rate steps by the Fed and the central banks that follow it are already priced into current prices. One thing is certain: market risks remain high and require a deft hand to keep the portfolio on track even in these turbulent times.

Article by Markus Polz

at CM-Equity AG

Editor’s Pick

Bleiben Sie auf dem Laufenden mit unserem Newsletter direkt in Ihrem Posteingang